Excel if Function Net Income or Net Loss

Net Income loss Income loss before provision for income taxes - Provision for income taxes. Be sure to type the comma.

Excel S If Function Iq Accounting Solutions Iq Accounting Solutions

26 READING READINESS INC.

. Net Income Total Revenue Gains - Total Expenses Losses Once youve created your income statement youll see how much youve made or lost in a period. Total income minus total expenses. Ending RE Beginning RE Net Income Dividends Assuming there are no dividends the change in retained earnings between periods should equal the net earnings in those periods.

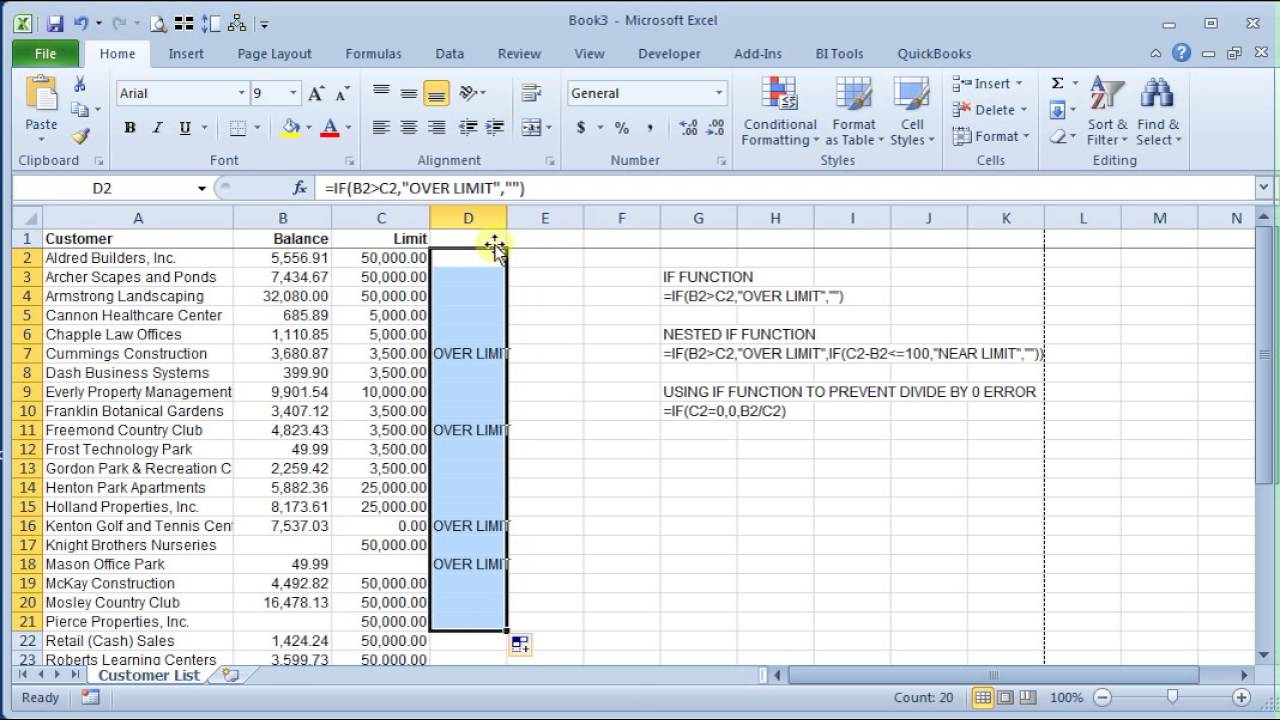

The format of this command is IF Logical test value if true value if false. For example if the value of this argument is the text string Net Income and the argument evaluates to TRUE the function returns the text Net Income. The formula for the Excel IF statement with OR function is.

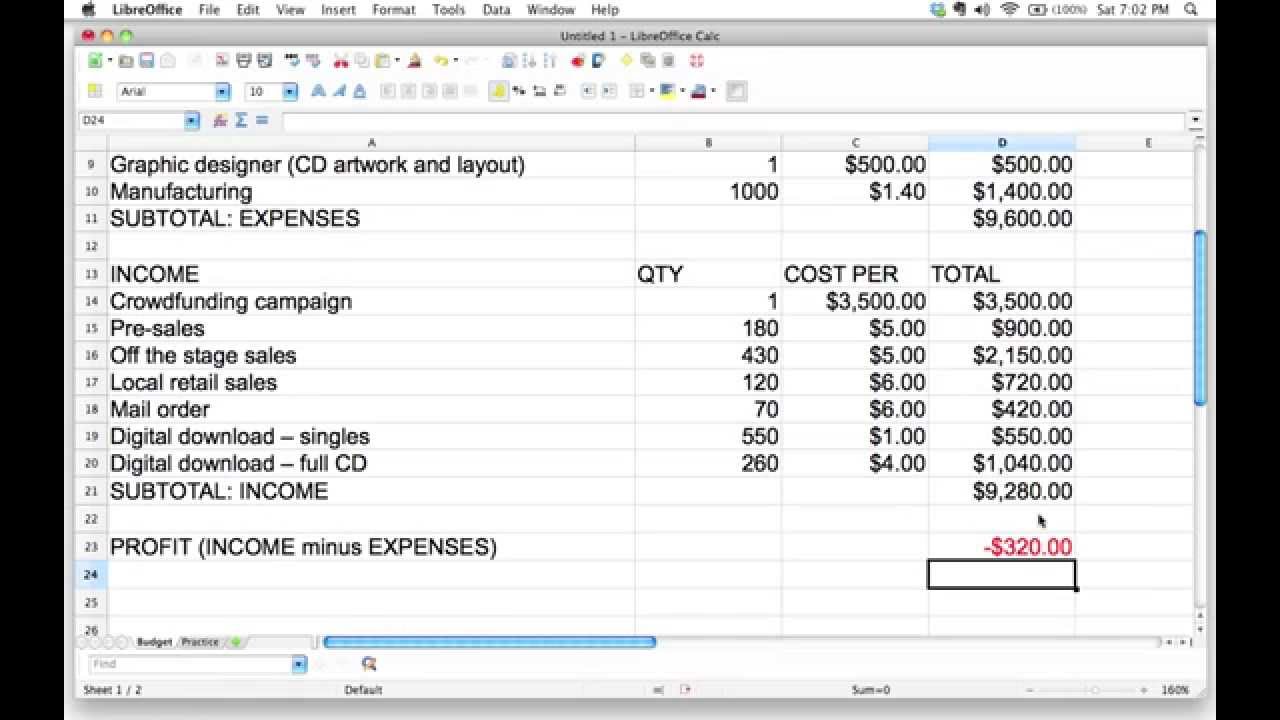

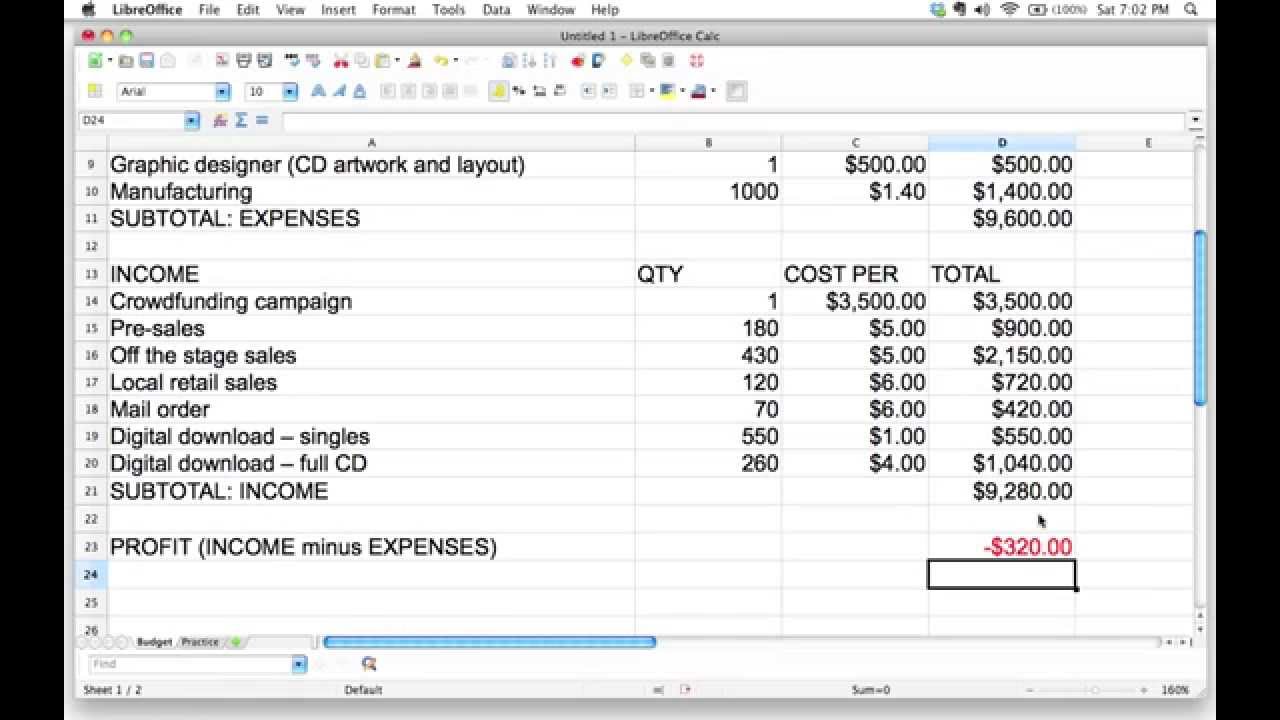

You will also see the amount youre making or spending per category. At the bottom of the spreadsheet click the Exercise Five tab. For example if this formula is say in C1 and you have formula somewhere else referring to the value of C1 such as.

Click in cell B3. Net Profit Margin Net Profit Total revenue x 100. This is the formula for finding ending retained earnings.

Now Wyatt can calculate his net income. View Full Size Image Type. Net Income loss per share Net income loss Weighted average number of shares.

Gross profit Income loss from operations Weighted average number of shares. Function to get three possible outcomes. Next Wyatt adds up his expenses for the quarter.

Net income flows into the balance sheet through retained earnings an equity account. Calculate net income The final row of the worksheet contains cells to calculate the net income. For the logical_test type B1.

Total Revenues 150000 Total Expenses COGS 100000 Expenses 60000 150000 100000 60000 150000 160000 -10000 Thus we are left with negative cash of 10000 after deducting the COGS and expenses from total revenues earned for that period. However try also what Mark suggested. This document is pretty simple.

26 27 28 29 30 31 32 33 READING READINESS Company Income Statement For the Month Ended January 31 20X1 Revenues. Or in plain English IF this is true then do this if not do that. Expenses 6000 2000 10000 1000 1000 20000.

Income loss from operations Gross profit - Total operating expenses. Activate cell B28. Lets walk through a couple of examples.

If you go for it and you need to do further computations that use these words you need to use the values in B1 instead. 3 noodles unlimited inc. To calculate total income tax based on multiple tax brackets you can use VLOOKUP and a rate table structured as shown in the example.

This is also an optional field that has the value or expression that is returned if the argument evaluates to FALSE. In Microsoft Excel the IF function is one of the most common and most useful. To illustrate assume no taxes are charged for Net Losses and for Net Income Before Tax of less than 5M.

Salary is less than 72000 - the limit of tax band 2 - then multiply by band 2 income tax or if salary is greater than 72000 use tax band 3 for calculation The formula so far would then look like this IF B9 E5 B9 C4 IF B9 E6. Test Prep Revenue Tutoring Revenue Other Revenues Total Revenues. Heres how to enter that final formula.

Income loss before provision for income taxes Operating expenses. Net Income Calculation using MS Excel. Net Profit Margin INR 30INR 500 x 100.

It can be any expression that can be evaluated to TRUE or FALSE like comparing one number or cell to another such as C2B2. 0 Net Income Before Tax5000 No Tax Due The table below presents the following results applying the Excel IF statement with OR formula. Gross income 60000 - 20000 40000.

Net Loss Formula Now we can calculate Net Loss as per below. For example if the value of this argument is the text string Net Loss and the argument. Net Profit Margin 600.

VLOOKUP inc rates31 inc - VLOOKUP inc rates11 VLOOKUP inc rates21 where inc G4 and rates B5D11 are named ranges and column D is a helper column. One tool for doing that is the IF function. Income loss before provision for income taxes Income from operations - Total interest and other income.

Its reference appears in the formula in cell B28. For the value_if_true type Loss be sure to type quotation marks and the comma. After entering the formula in cell C42 use the Excel IF function to label cell B42 as either Net Income or 25 Net Loss as appropriate based on the value calculated in cell C42.

Calculation of net profit margins by using a formula. Total interest and other income expenses Depreciation and amortization Revenues. The Net Income Total revenue total expenses.

Loss Break Even or Net Income. Interest and other income expenses. How To Calculate Your Net Income Using Microsoft Excel Tutorials.

The formula in G5 is. View Full Size Image Type. First Wyatt could calculate his gross income by taking his total revenues and subtracting COGS.

After entering the formula in cell 042 use the Excel IF function to label cell B42 as either Net Income or 25 Net Loss as appropriate based on the value calculated in cell C42. View Full Size Image Click cell B6. If column A has customer names in it column B has their balances and column C shows their credit limit.

Popular Course in this category. It can also be text such as B2fragile. Snapshots from the annual 10-K filing of the Company to SEC is as below.

5 income statement 5 for the year ended december 31 20x1 7 sales revenue a b с d credits debits 37500 28600 43300 2000 69000 7 9. The company has earned 600 of net profit margins against its total revenues in the financial year 2018. All you need to remember is this formula.

Net income 103000 80500 Net income 22500 Example 2 Let us see the Profit and Loss statement of Apple and the net income reported by the Company. IFORNet Income Before Tax. How to calculate the Net and Gross Salary of an In.

After entering the formula in cell b52 use the excel if function to label cell a52 as either 2 net income or net loss as appropriate based on the value calculated in cell b52. IF B10ProfitIF B10LossEven would work. This is the value if the logical_test evaluates to TRUE.

Basic Diluted Net income loss per share - basic Net income loss per share.

Using Spreadsheet Formulas To Figure Out Profit Or Loss In A Budget Youtube

Beginning Accounting Can You Take A Look At This Accounting Accounting Jobs Accounting And Finance

Income Statement Components Under Ias 1 Income Statement Financial Statement Analysis Financial Statement

Comments

Post a Comment